How Much Should My Down Payment Be?

I get a lot of questions from Buyers about the Down Payment and how much it should be. One of the main misconceptions is that it must be, at a minimum, 20% of the purchase price. There is no golden rule about down payment amounts and, more importantly, they will vary from buyer to buyer. It is best to consult with your Lender and REALTOR to determine what is best for your situation.

For more on this, take a look at the article below from The National Association of Realtors:

Down Payment Misperceptions Persist

The majority of home buyers—87%—finance their home purchase. But some aspiring buyers may delay their purchase due to persistent myths over down payment requirements.

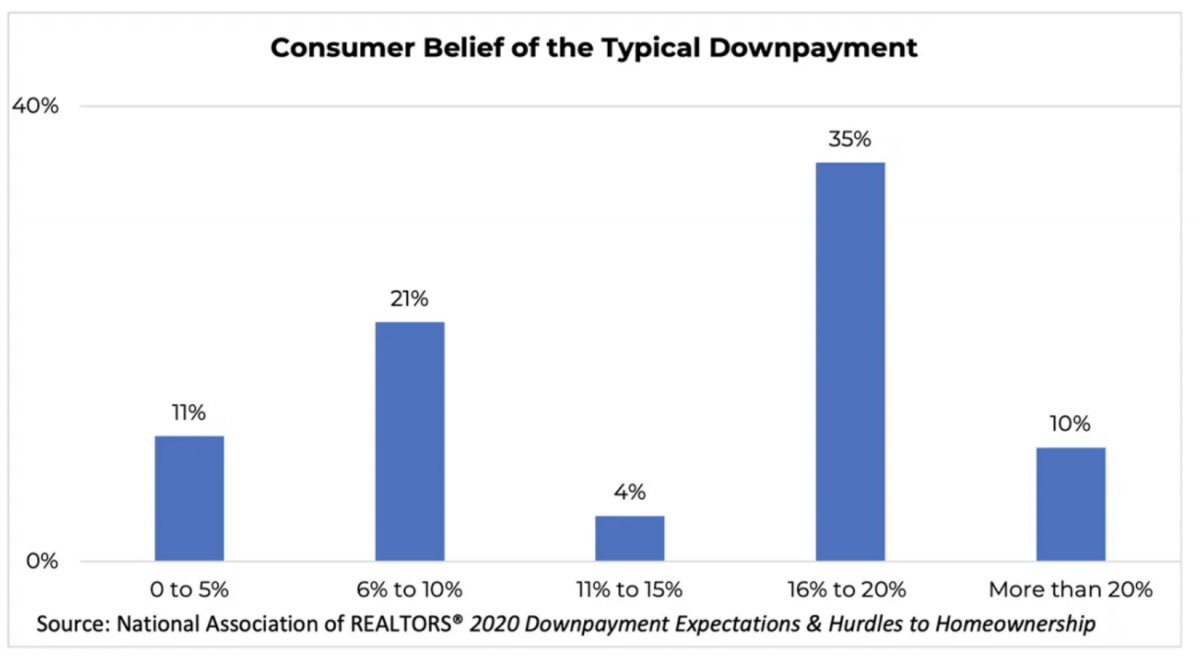

Thirty-five percent of consumers believe they need a down payment of 16% to 20% of the purchase price. Ten percent believe they need more than 20% for a down payment to purchase a home, according to survey data from the National Association of REALTORS®. Home price increases in the double digits over the past year alone make saving for such a large down payment an even tougher hurdle.

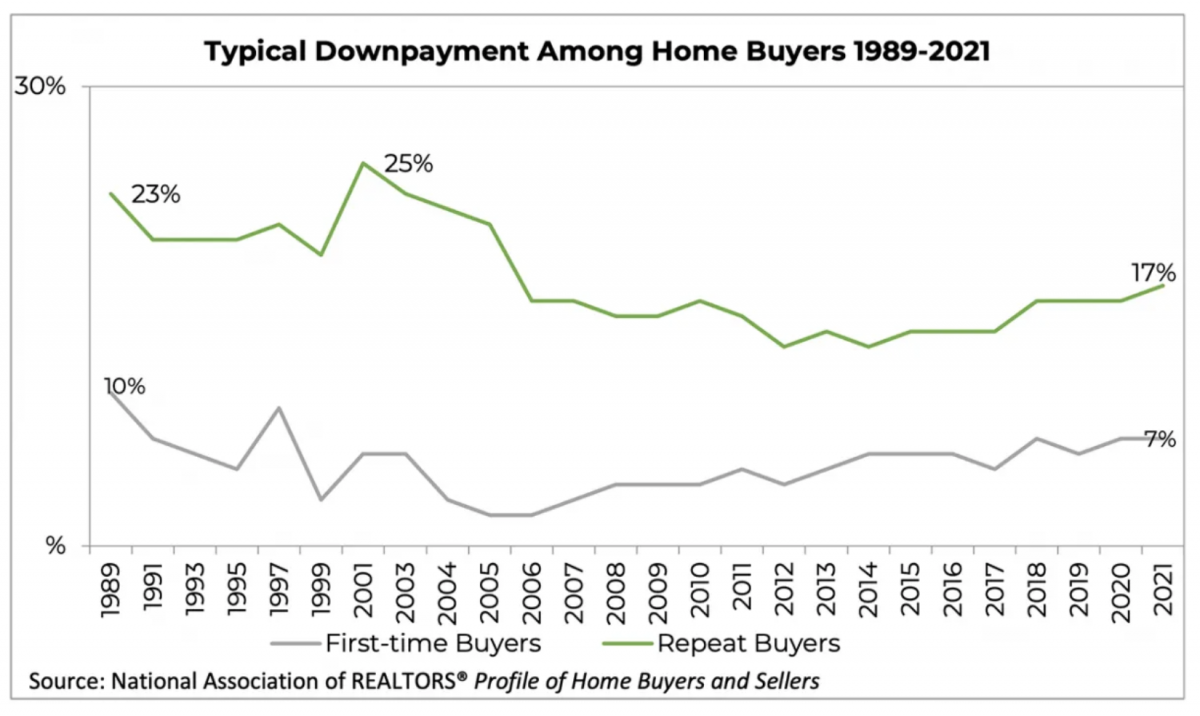

However, the typical down payment is much lower. For first-time home buyers, the average down payment over the last three years has ranged between 6% and 7%, Jessica Lautz, NAR’s vice president of demographics and behavioral insights, writes on the association’s blog.

For repeat buyers, the typical down payment was 17% last year, according to NAR. The down payment among those buyers has been rising over recent years as home equity for owners has grown. Many repeat buyers roll the equity from the previous home into buying their next home.

Buyers have several loan options. About 23% of first-time buyers represented in the survey chose a Federal Housing Administration loan. FHA loans allow borrowers to put down as little as 3.5% on the purchase of a home.

At HUD.gov(link is external), potential buyers can look for an interactive portion of the site that can direct them to state and local lending programs they may qualify for.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link